Key Takeaways

- New Jersey sues RealPage and 10 major landlords for allegedly colluding to inflate rent using pricing algorithms.

- The alleged rent-setting scheme may have artificially raised prices for hundreds of thousands of renters across the state.

- Legal consequences could reshape how investors approach rent pricing and data-sharing technology nationwide.

New Jersey’s rental market just exploded with scandal — and it’s a nightmare for investors and tenants alike.

State authorities have unleashed a legal firestorm, accusing 10 of the largest landlords and property management software giant RealPage of operating a rent-inflating cartel that preyed on hundreds of thousands of renters.

Is this the smoking gun that proves corporate greed is wrecking America’s housing market?

Here’s what’s about to turn the entire New Jersey rental world upside down:

- New Jersey Attorney General Matthew Platkin sues RealPage and 10 massive landlords for “cartel-like” rent fixing.

- Allegations that private data sharing and RealPage’s algorithm fueled skyrocketing rents, crushing renters.

- Lawsuit seeks sweeping penalties, corporate monitors, and the full disgorgement of allegedly illegal profits.

It’s no longer just speculation.

Let’s dive into the chaos that’s rocking New Jersey’s real estate investing world.

New Jersey Drops a Legal Atomic Bomb on RealPage and Landlords

In a federal lawsuit, New Jersey Attorney General Matthew Platkin accused RealPage Inc. and ten of the state’s largest property management firms of colluding to rig the rental market.

The firms allegedly used RealPage’s algorithmic software not just to set rents, but to coordinate them, turning what should have been a competitive market into a rigged, price-fixing machine.

“These defendants work together as a rent-setting cartel conspiring to make themselves richer by preying on thousands of New Jerseyans just looking for a safe, affordable place to live,” Platkin thundered at a Newark press conference.

The lawsuit names a who’s-who of property giants:

- Morgan Properties Management Company

- AvalonBay Communities

- Kamson Corporation

- LeFrak Estates (includes Realty Operations Group)

- Greystar Management Services

- Aion Management

- Cammeby’s Management Company of New Jersey

- Veris Residential Inc.

- Russo Property Management

- Bozzuto Management Company

Platkin’s office made it brutally clear: the defendants allegedly exchanged non-public, confidential data — including occupancy rates, pricing strategies, and concessions — to inflate rents systematically and avoid the competitive pressures that should have kept prices reasonable.

RealPage Faces a New Front in Its National Legal War

RealPage, already under fire from the U.S. Department of Justice and multiple class action lawsuits, now faces an all-out offensive in New Jersey.

State prosecutors are seeking:

- An injunction to stop the rent-collusion practices.

- Full repayment of “illegal profits.”

- Civil penalties.

- Appointment of a corporate monitor at the defendants’ expense.

And it could get even worse.

The New Jersey AG’s office hinted that more defendants could be added as investigations deepen.

Jennifer Bowcock, RealPage’s senior vice president of communications, predictably fired back, calling the lawsuit “devoid of merit” and claiming their software merely helps landlords comply with housing laws, not break them.

But critics like Caroline Ciccone, president of watchdog Accountable.US, praised the lawsuit as a necessary strike against a system that has, in her words, “allowed corporate landlords to push rental rates to historic highs.”

New Jersey’s Renters: Collateral Damage in a Game of Greed

The consequences have been devastating.

A Harvard University study cited by Platkin shows half of New Jersey renters are now cost-burdened, meaning they spend over 30% of their income just to keep a roof over their heads.

RELATED CONTENT

For real estate investors, the lawsuit is a giant warning shot.

Artificially inflated markets collapse — and if the court agrees that these landlords rigged prices, the fallout could lead to massive rent rollbacks, asset devaluations, and corporate reputations shattered.

The numbers are staggering:

| Category | Statistic |

|---|---|

| Affordable Housing Shortage | 200,000 units in New Jersey |

| Renters Cost-Burdened | 50% of New Jersey renters |

| Defendants Named | 10 major landlords + RealPage |

| Laws Broken | Sherman Act, NJ Antitrust Act, NJ Consumer Fraud Act |

Platkin summed it up with a chilling declaration: “I’m not going to tolerate corporate greed that violates the law and hurts our residents.”

How RealPage’s Alleged Rent Manipulation Changed the Game for Investors and Homeowners Alike

The lawsuit filed by New Jersey’s Attorney General isn’t an isolated shot — it’s the latest in a long series of alarms exposing RealPage’s sweeping influence on the rental market.

To truly grasp the depth of the alleged manipulation, you need to understand how RealPage reshaped the way landlords priced apartments, crushed traditional competition, and triggered ripple effects that hit both real estate investors and homeowners hard.

RealPage’s Rise: The Quiet Power Behind Multifamily Rent Pricing

Founded in 1998, RealPage sold itself as a “revenue management” solution for landlords. What sounded innocuous at first quietly became an industry-standard system for rent setting.

- Algorithmic Rent Pricing: Instead of landlords setting rents based on gut, comps, or local agent advice, RealPage introduced dynamic pricing algorithms that factored in real-time data across entire markets.

- Data Pooling: Major landlords, often competitors, allegedly shared confidential lease rates, occupancy rates, concessions, and inventory numbers into a single RealPage database.

- Market Coordination: With access to near-complete market visibility, landlords could align rental prices, not based on competitive undercutting, but based on maximizing collective profits without triggering a race to the bottom.

The Department of Justice’s 2023 antitrust lawsuit and multiple private class actions have similarly accused RealPage of helping turn what should be a competitive rental market into what prosecutors call an “informal cartel.”

Investors: Short-Term Wins, Long-Term Risk

At first glance, many real estate investors, especially those in large multifamily, benefited tremendously from RealPage’s strategy.

- Higher Net Operating Income (NOI): With rents rising across entire markets, property NOI figures looked better than ever. Valuations soared.

- Predictable Revenue Streams: Standardized rent increases made cash flow forecasting easier, and properties became more attractive to institutional buyers.

- Asset Appreciation: As rents inflated, so did the perceived value of the properties themselves, feeding a boom in multifamily investment portfolios.

But the short-term upside masked massive underlying risks:

- Artificial Price Floors: By pushing rents higher than true market demand would allow, properties became vulnerable to vacancies once tenant pain thresholds snapped.

- Regulatory Backlash: Investigations, lawsuits, and potential rent control measures have started to gather steam nationwide, threatening to cap future returns.

- Devaluation Risk: If courts rule against RealPage and demand structural changes or damages, previously “safe” multifamily investments could see rapid value erosion.

In essence, many investors may have unknowingly built their portfolios on an unstable foundation of manipulated market data, and the house of cards may soon collapse.

Homeowners: Collateral Damage in the Race for Profits

While RealPage targeted rental markets, homeowners also felt the sting of its influence.

- Spillover Effects on Home Prices: As rents soared, more tenants, desperate to escape rising monthly costs, flooded into the homebuyer market, driving up demand and home prices.

- First-Time Buyer Shutout: Higher home prices and tougher competition pushed many first-time buyers out of the market, forcing them to remain renters, stuck in the inflated pricing trap.

- Community Instability: In many suburban and urban markets, rental inflation led to higher turnover, eviction spikes, and displacement of longtime residents, further destabilizing neighborhoods and schools.

For homeowners relying on stable, growing communities, the unchecked rise of rental prices and displacement fractured once-solid community bonds and drove an affordability wedge deeper into local economies.

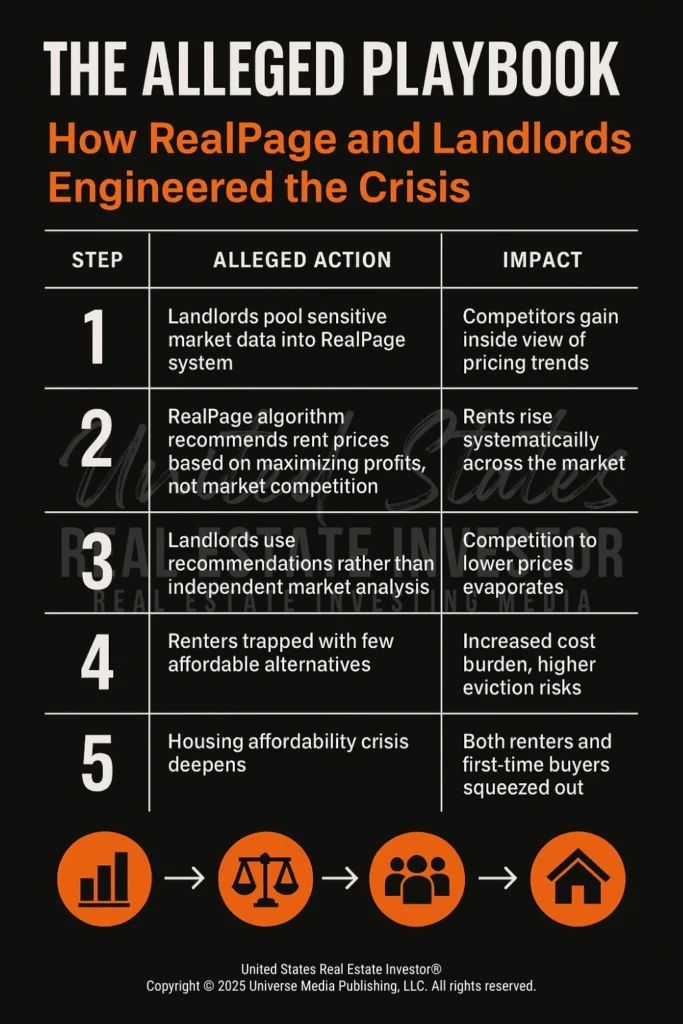

The Alleged Playbook: How RealPage and Landlords Engineered the Crisis

Here’s a simple breakdown of the alleged RealPage-enabled manipulation process:

| Step | Alleged Action | Impact |

|---|---|---|

| 1 | Landlords pool sensitive market data into RealPage system | Competitors gain inside view of pricing trends |

| 2 | RealPage algorithm recommends rent prices based on maximizing profits, not market competition | Rents rise systematically across the market |

| 3 | Landlords use recommendations rather than independent market analysis | Competition to lower prices evaporates |

| 4 | Renters trapped with few affordable alternatives | Increased cost burden, higher eviction risks |

| 5 | Housing affordability crisis deepens | Both renters and first-time buyers squeezed out |

Why This Matters for the Future of Real Estate Investing

The lawsuit against RealPage is more than just a court battle — it’s a referendum on how technology and data have been weaponized in real estate investing.

- Technology isn’t neutral. When wielded without oversight, even the most “innovative” software can distort markets and destroy public trust.

- Long-term stability trumps short-term greed. Sustainable investing relies on healthy, competitive markets, not secretive price manipulation.

- Regulation is coming. Investors who rely too heavily on algorithmic pricing may find themselves facing a drastically different landscape in the years ahead, with tighter restrictions, price transparency requirements, and legal minefields.

RealPage promised landlords higher profits. What it delivered, according to authorities, was a housing affordability crisis that hurt millions — and it’s a lesson investors can no longer afford to ignore.

Assessment

New Jersey’s explosive lawsuit against RealPage and ten of the state’s largest landlords peels back the curtain on a growing crisis many in the real estate investing world tried to ignore.

What was once billed as technological innovation — algorithm-driven rent setting — now stands accused of fueling one of the most aggressive affordability collapses in recent memory.

By allegedly pooling private data and coordinating rents through RealPage’s software, these companies are charged with dismantling the very foundation of free-market competition, resulting in sky-high rental prices that trapped both tenants and first-time homebuyers. Investors who unknowingly benefited from inflated NOI and asset values now face the chilling reality that those gains may have been built on legally questionable, and ultimately unsustainable, practices.

This legal battle is more than just a political spectacle; it’s a flashing red warning light for every multifamily and single-family investor.

Regulatory scrutiny is no longer coming — it’s already here.

Lawsuits, legislation, and public outrage are reshaping the future of rent pricing, data use, and property valuation across the country.

Homeowners, too, have suffered as displaced renters flooded into an already competitive housing market, pushing home prices beyond reach for countless working families.

Community instability, higher eviction rates, and fractured neighborhoods are now bitter side effects of unchecked corporate rent strategies.

If New Jersey succeeds, the ramifications for the entire real estate industry will be seismic. Investors, operators, and property owners must now rethink not just their pricing strategies, but their ethical obligations to the markets they serve.

The age of invisible algorithmic manipulation is ending, and those who don’t adapt may find themselves on the wrong side of a historic shift in American housing.

Related Content:

- The Mirage at Desert Pines: Is Las Vegas’s “Biggest Housing Project Ever” a Dangerous Gamble in Disguise?

- Donald Trump Victory Sparks Massive Optimism and Growing Caution in Real Estate Markets

- Real Estate Showdown (Baby Boomers vs. Millennials in the Battle for Homeownership)

- Shocking Decline of Starter Homes (Increasing Crisis for First-Time Buyers)