Crypto Real Estate Investing Boom Creates New Landlord Class

Several startups and decentralized organizations are marketing the use of blockchain-based tokens to enable people to invest as little as $50 in rental properties, causing a boom in crypto real estate investing.

What is crypto real estate investing?

Crypto real estate investing is conducting traditional real estate investing transactions using cryptocurrency instead of fiat currencies. Now that many well-known banking, mortgage, and real estate entities have begun embracing the use of crypto in real estate, it has given many people the opportunity to become part of this new landlord class who would not have the chance otherwise.

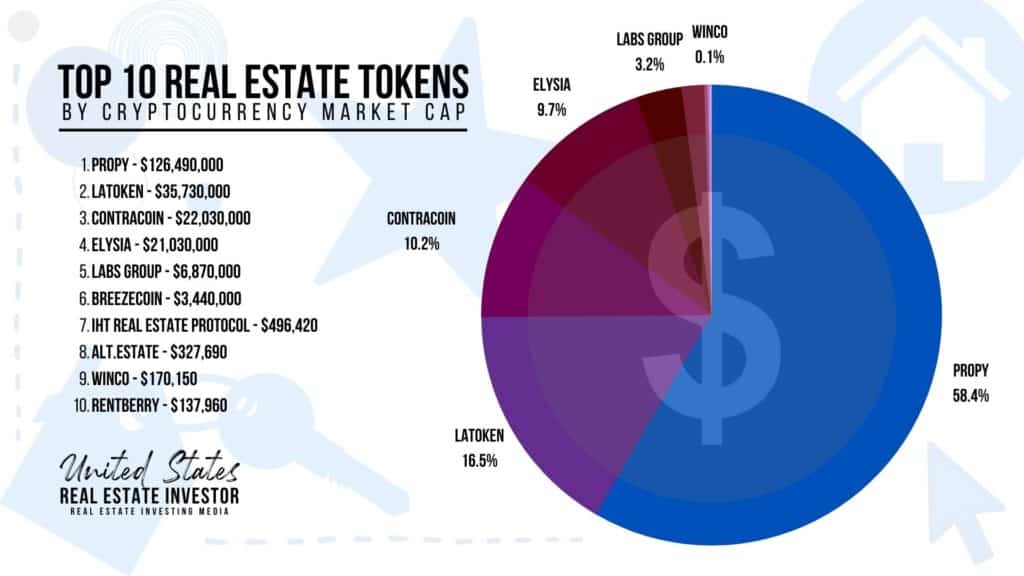

According to an article by UpNest, one of the most popularly used ways real estate entrepreneurs are attempting to incorporate digital currencies into business transactions today is by creating new currencies and tokens for buying, renting, trading, and investing in real estate, without having to conduct a traditional transaction.

What are the technical details?

These days, new real property tech startups are encouraging blockchain-based real estate transactions more and more. One of the most recent ways people are cooperating worldwide through a voting system on possibly just one real estate investment property is through the use of a DAO.

What is a DAO?

A DAO (Decentralized Autonomous Organization) is a new type of business organization that’s been gaining popularity recently.

A DAO is essentially a new way to form businesses and is essentially a company without the need for any human involvement.

Many people have started comparing a DAO to an ICO. There are many similarities, but there is a key difference. An ICO (Initial Coin Offering) is essentially an IPO for a cryptocurrency or blockchain-based product.

A DAO is an organization that doesn’t have a real identity or location. It’s controlled by the members of a blockchain community.

Real estate investors who participate in DAOs by purchasing a membership by way of a governance token, collectively have to agree upon real estate decisions for things as minimal as a new ceiling fan.

In a DAO, there is no central organization leader. Every move and choice is collectively decided.

Real Estate Crowdfunding Is Nothing New

For the average investor, the concept of real estate investing is nothing new. Websites such as Fundrise and RoofStock have for years offered the opportunity to buy shares of homes and commercial buildings located in distant places, but with a minimum investment of $1,000 or more and limitations on how quickly their value may be withdrawn.

Companies like Lofty AI are developing a fully unregulated market in which just about anyone can buy a token corresponding to a stake in a single-property rental business for only $50. Each token represents ownership of a share of Lofty AI’s Delaware LLC.

Lofty AI is still quite small. Its marketplace for business rental property commenced within the past year and so far lists about ninety vacation rentals, mostly in Rust Belt states including Illinois, Michigan, Missouri, and Ohio. Lofty AI utilizes property management companies to handle the regular rental operations.

Should you get into crypto real estate investing?

Crypto real estate investing is on the rise, and with good reason. This highly technological market is still relatively new and there are a lot of opportunities to make money. Some experts say that if you’re looking for a way to make some extra money, or invest in a high-return investment, crypto real estate investing may be the right choice for you. Experts also say to remember that crypto investing is one of the most volatile investing strategies available, so do your research.

As members of companies like Lofty AI, many investors have begun to think about the historically informal communications between landlord and tenant as well as the processes of eviction. Experts mention the possibilities of capital loss in a market downturn where real estate DAO members may have to mitigate property maintenance through the financial storms in a new way. In a market crash where vacancies can increase, real estate DAOs will need to have a strong maintenance fund as a backup to keep from becoming slumlords or absentee landlords.

When it comes to considering crypto real estate investing, investors should keep in mind that government regulation remains an evolving query for cryptocurrency markets. Lofty AI has taken the position that its tokens do not meet the federal legal definition of securities, and its marketplace does not meet the definition of an exchange, which suggests the trend thus far has helped prevent many regulations from the Securities and Exchange Commission.

Even though there are no government regulations that resemble laws for real estate DAOs, some have been formulating policies and procedures to govern their own activities, such as forbidding any entity from owning more than a certain percentage of a property. With self-regulation like this, DAOs continue to further the ultimate mission of decentralization.

In Conclusion

Are you considering crypto real estate as your next investment towards financial freedom?

Please, leave us a comment below about what you think and if you think there should be more or less regulation of cryptocurrency transactions in the future.

Quick Content Suggestions

Buying This Type of Property Could Double Your Passive Income

RELATED CONTENT

https://www.fool.com/real-estate/2022/03/12/buying-this-type-of-property-could-double-your-pas/