Key Takeaways

Deep-sea exploration and real estate investing share similarities, including the necessity to take calculated risks and venture into unknown territories.

-

Risk management is crucial both in undersea expeditions and real estate investing. The Titan submersible incident emphasizes the importance of assessing and mitigating risks to prevent tragic outcomes.

-

High-stake decisions are inherent in both realms. The Titan incident and real estate investments require prompt, well-informed decisions that can significantly impact the final outcomes.

-

Success in both deep-sea exploration and real estate investing can lead to significant rewards. While the former offers the thrill of discovery, the latter can yield substantial financial returns when risks are well-managed.

-

The Titan submersible incident provides valuable lessons for real estate investors, including the importance of rigorous preparation, the need for effective risk management, and the potential high rewards of well-informed decision making.

OceanGate Titan Submersible Incident as a Metaphor for Real Estate Investing (Risk, Reward, and Adventure): Similarity In Contrast

On June 18, 2023, the maritime world woke to one of the most shocking disasters in recent times – the implosion of the Titan submersible.

OceanGate, an American tourism company, had embarked on a routine expedition to observe the wreck of the Titanic, located in the North Atlantic Ocean, roughly 400 nautical miles off Newfoundland, Canada.

Five individuals, including OceanGate CEO Stockton Rush, and adventurous passengers Hamish Harding (chairman of Action Aviation), Shahzada Dawood and his son Suleman Dawood, and Paul-Henri Nargeolet, descended into the depths aboard the Titan, a submersible made from carbon fibre and titanium.

Approximately 1 hour and 45 minutes into the dive, all communication with the vessel was lost. A frantic search and rescue operation ensued, ultimately revealing a debris field but no survivors.

The conclusion was clear: the Titan had imploded due to a failure of the pressure hull, tragically ending the lives of its five occupants.

Setting sail on its maiden voyage on April 10, 1912, the Titanic was one of the largest and most opulent ships in the world, displacing over 52,000 tons when fully laden and measuring about 882.5 feet in length. The ship travelled from Southampton, England, to New York City, and carried around 2,200 people, with approximately 1,300 of them being passengers.

On the night of April 14, the Titanic struck an iceberg, causing its hull to breach. Despite its design featuring 16 compartments intended to contain water in the event of a breach, the damage was catastrophic. The ship began to sink, with the bow going under first while the stern rose out of the water, eventually standing almost perpendicular to the ocean surface before it too disappeared beneath the waves. - Source: Britannica

The Titan submersible incident, while tragic, serves as a potent metaphor for the world of real estate investing.

Both scenarios involve delving into the unknown, requiring considerable investment and offering potentially significant rewards.

Yet, they also both carry inherent risks and potential for disaster. Just as the Titan embarked on a daring exploration of the ocean depths, real estate investors launch ventures into the market’s murky waters.

The parallels between these two disparate domains – the deep sea and the financial markets – can offer valuable insights and lessons for those who navigate the turbulent seas of real estate investing.

This article aims to elucidate those lessons, using the Titan incident as a lens through which to view and understand the complexities and nuances of real estate investing.

Spirit of Exploration: Venturing into the Unknown

The allure of the unknown motivates both deep-sea explorers and real estate investors. They are driven by a thirst for discovery and the thrill of what lies beneath the surface, be it the ocean’s depths or the fluctuating markets.

The quest for the Titanic’s wreck by the Titan submersible (also referred to as the Titan submarine) in the North Atlantic Ocean mirrored the journey undertaken by investors who delve into the vast sea of real estate opportunities.

These explorers, whether underwater or in the financial realm, know that the path to discovery and potential rewards is fraught with uncertainty.

The implosion of the Titan underscores the inherent risks involved in such ventures.

RELATED CONTENT

Likewise, real estate investments can implode, metaphorically speaking, if market conditions sour or if due diligence is not thorough.

A day before the tragedy, filmmaker James Cameron, who has extensive experience with deep-sea submersibles, highlighted a potential flaw in the Titan's design. He stated that the submersible's single-compartment design might be vulnerable in case of an emergency. He felt that submersibles should ideally have separate pilot and passenger compartments to allow the passengers to be rescued if something were to go wrong in the pilot's compartment.

The Titan submersible, capable of carrying five people, had previously conducted over 100 successful dives to the Titanic. The submersible was designed to withstand pressures at a depth of 4,000 meters, and it had a 21cm-thick quartz dome that provided panoramic views to its occupants. The Titan was the first submersible to offer such expansive views to non-pilot passengers.

According to a report from the mission control team, the submersible lost contact with the surface ship and was declared missing on June 1, 2023. After an extensive search and rescue operation involving multiple nations and organizations, the submersible was found at a depth of about 3,800 meters on June 4, 2023. All five passengers were found deceased inside the submersible, indicating that they did not have an opportunity to escape after the incident occurred.

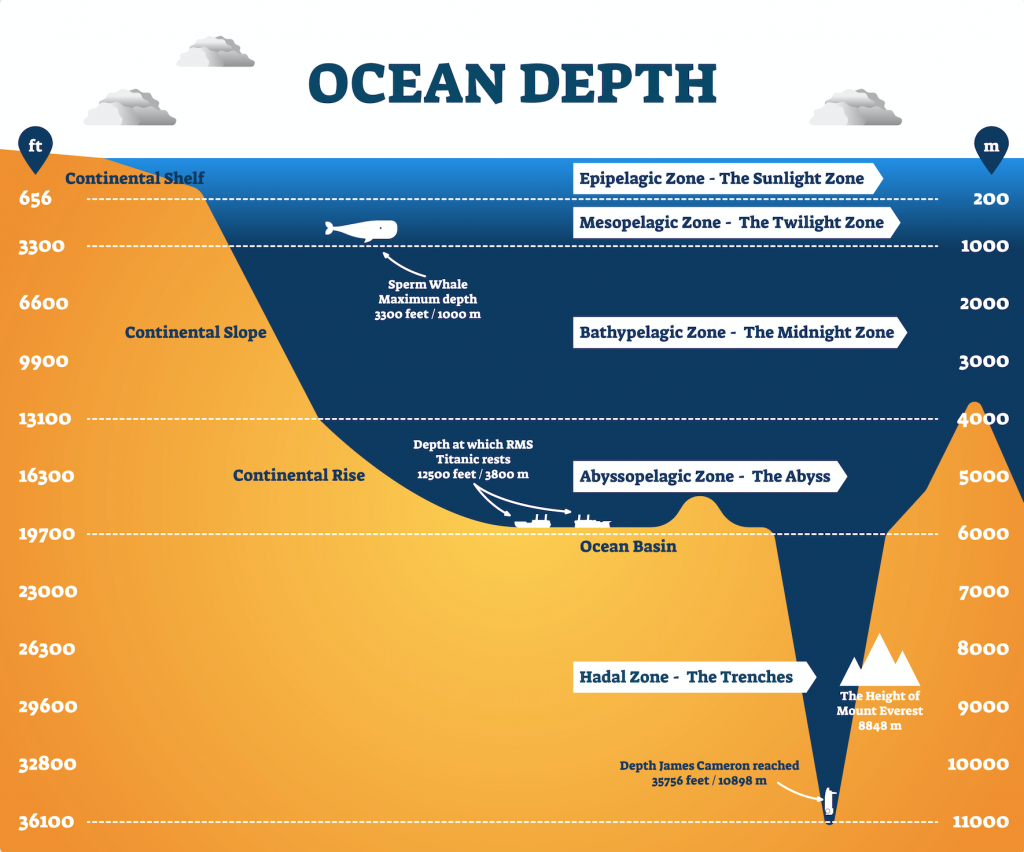

The reason for the Titan submersible's failure is still under investigation as of the writing of this article. However, one of the factors that contributed to the tragedy might be the depth at which the submersible was operating. It was found at a depth of 3,800 meters, which is close to its maximum operational depth. This suggests that the submersible might have been operating near its limits, which could have contributed to the failure.

"The Mariana Trench is deeper than any mountain on Earth is tall. The sheer depth of the Mariana Trench dwarfs even the legendary height of Mount Everest."

Image courtesy of americanoceans.org

Both deep-sea exploration and real estate investing call for meticulous preparation. Before the Titan’s tragic dive, OceanGate and its team would have engaged in exhaustive research, from understanding the Titanic’s location and condition to ensuring the submersible’s technical proficiency.

With inner details still perpetually unknown, it is pure speculation that the OceanGate team conducted due diligence prior to that fateful venture.

Similarly, successful real estate investing hinges on comprehensive market research, rigorous property inspections, and a well-formulated investment strategy, which can undoubtedly stop the completion of any real estate investing expedition when these proper procedures are not executed and without gathering necessary intel.

Beyond the spreadsheets and dive plans, both pursuits also demand a boldness to embrace calculated risks. In the same way that the Titan’s crew knowingly descended into the perilous deep, real estate investors must sometimes plunge into unpredictable markets, buoyed by their conviction in the potential rewards.

The spirit of exploration, therefore, is about striking that delicate balance between prudence and daring, navigating the known and embracing the unknown.

risk management

Risk management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. These threats, or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters.

The goal of risk management is to mitigate the effects of these risks on an organization. It involves understanding potential risks, making decisions about how to address these risks, and implementing strategies to manage them. This can include transferring the risk to another party, avoiding the risk, reducing the negative effects of the risk, or accepting some or all of the potential or actual consequences of a particular risk.

Risk management is a crucial part of any organization’s strategic management. It’s the responsibility of risk management teams to ensure that the organization doesn’t take on unnecessary risks while operating and that any risks it does take are ones that the organization can handle.

Role of Risk Management: Navigating the Depths Safely

The tragic outcome of the Titan submersible expedition underscores the critical importance of managing risk. Initial findings indicate that the failure of the pressure hull, leading to the submersible’s implosion, might have been a consequence of insufficient safety measures.

The incident serves as a stark reminder that while exploration and adventure are thrilling, they also come with hazards that need to be diligently anticipated and mitigated.

Similarly, real estate investing is not without its perils. The landscape of property investment is replete with tales of failed projects, financial losses, and legal disputes.

Like deep-sea explorers, investors must anticipate these pitfalls and craft strategies to circumnavigate them. They must assess market trends, understand property valuations, conduct rigorous due diligence, and maintain an emergency fund, among other safety measures.

These are akin to the safety checks and backup systems employed in submersible expeditions, designed to protect against catastrophic failures.

Real-world examples of risk management in real estate investing are numerous. For instance, a property investor might mitigate risk through diversification, by investing in properties across different regions and sectors. This strategy can protect the investor’s portfolio from localized market downturns.

Another example is the use of a contingency clause in a property purchase agreement, which allows the investor to back out of a deal if certain conditions, such as a satisfactory property inspection, are not met.

These examples illustrate how effective risk management can protect real estate investors from substantial losses, just as comprehensive safety protocols can safeguard explorers from the inherent dangers of deep-sea expeditions.

safety procedures

Deep sea/ocean exploration, such as the type carried out using the OceanGate Titan submersible, typically involves a comprehensive pre-trip and post-trip checklist to ensure the safety of the vehicle and its passengers.

The checks would typically include the following:

Pre-Trip Checks:

- Submersible Integrity Check: This includes checking the hull for any signs of damage or corrosion, inspecting seals and openings for any leaks, and checking the integrity of windows and viewports.

- System Checks: It’s essential to test all onboard systems including life support, communications, propulsion, navigation, lighting, emergency systems, and scientific equipment.

- Battery Checks: Given that many deep-sea submersibles are battery-powered, check the battery levels and ensure they are fully charged and functioning properly.

- Ballast System Checks: The ballast systems, which control the submersible’s buoyancy, should be tested to ensure they are operating correctly.

- Pressure Testing: This is critical for deep-sea exploration. The submersible should undergo pressure testing to simulate the extreme conditions it will face in the deep ocean.

- Life Support Systems: Check the oxygen supply, carbon dioxide scrubbers, temperature control systems, and any other life support systems.

- Emergency Systems: Check the emergency ascent system, emergency oxygen supply, and other safety equipment.

- Communication Systems: Ensure that both internal and external communication systems are working correctly.

- Passenger Briefing: All passengers should be thoroughly briefed on safety procedures, emergency protocols, and the use of safety equipment.

Post-Trip Checks:

- Debriefing: A post-trip debriefing should be conducted to discuss any issues encountered during the journey.

- Vehicle Inspection: Post-trip inspection of the submersible to check for any damage or issues that might have arisen during the journey.

- System Checks: All systems should be checked again to ensure they are still functioning correctly after the trip.

- Data Review: Review the data captured during the mission for any anomalies or issues.

- Maintenance and Servicing: Any required maintenance or servicing of the submersible and its equipment should be carried out.

- Reporting: Any incidents, near misses, or malfunctions should be reported and documented as per the organization’s safety procedures.

Safety procedures can vary depending on the specific model of the submersible and the nature of the exploration.

High Stakes of Decision Making: Understanding the Consequences

The Titan incident involved a series of high-stakes decisions. One of the most critical was the choice to venture deeper into the ocean, despite knowledge of the submersible’s downgraded depth rating.

This decision, ultimately linked to the catastrophic failure of the vessel, underscores the profound impact of such choices, particularly in high-risk environments like deep-sea exploration.

Real estate investing, like deep-sea expeditions, is marked with momentous decision-making junctures. These include selecting a property, deciding on the amount to invest, choosing whether to renovate, rent, or resell, and determining when to exit an investment.

Each of these decisions can significantly impact the investment’s outcome, much like the choices made during the Titan expedition had severe consequences.

Take the choice of property location, for example. Selecting a property in an area poised for growth could result in substantial returns, mirroring the potential rewards of a successful deep-sea expedition.

Conversely, investing in a declining area could lead to losses, analogous to the disastrous outcomes when high-stakes decisions go awry in extreme environments.

This parallel underscores that understanding the potential impacts of decisions is crucial, whether you’re exploring the ocean’s depths or navigating the real estate market.

stockton rush, oceangate ceo

In 2019, Rush complained about what he saw as overly strict regulations in the US submarine industry, saying “There hasn’t been an injury in the commercial sub industry in over 35 years. It’s obscenely safe, because they have all these regulations.” 1

In 2021, he acknowledged that his Titan submersible had “broken some rules.” He said he deviated from the norm by creating the sub with carbon fiber and titanium, but that breaking those rules allowed for innovation: “You’re remembered for the rules you break. I think I’ve broken them with logic and good engineering behind me. Carbon fiber and titanium? There’s a rule you don’t do that. Well, I did. It’s picking the rules that you break that are the ones that will add value to others and add value to society. And that really, to me, is about innovation.” 2

Also in 2021, Rush expressed his view on the future of mankind in relation to underwater exploration: “Because this is where we’re going to find strange new lifeforms, and the future of mankind is underwater. It’s not on Mars, we’re not going to have a base on Mars or the moon. If we trash this planet, the best lifeboat for mankind is underwater.” 3

Despite being warned multiple times about safety, including concerns about weaknesses in the hull of the Titan and experimental approaches, Rush continued with his plans. 4

Thrill of Discovery: Reaping the Rewards

Successful deep-sea exploration can yield immense rewards, not just in the form of tangible findings, but also in advancing our understanding of the marine world.

For instance, the Titan submersible’s past dives into the Titanic revealed details about the historical ship’s condition, contributing to a broader knowledge base about the famous vessel and its fate.

These explorations were filled with the thrill of discovery, revealing aspects of history hidden beneath the ocean’s surface.

Much like the potential rewards of successful deep-sea exploration, well-managed risks in real estate investing can lead to high returns.

Successful investors can reap substantial financial gains, whether from rental income, property appreciation, or profit from a sale. But beyond monetary rewards, real estate investing also offers the joy of discovery—unearthing undervalued properties, spotting market trends before others do, or revealing a property’s potential with the right renovations.

As with deep-sea exploration, the thrill of discovery in real estate investing can be a potent, seductive motivator, driving investors to navigate risks for the chance of significant rewards.

Lessons Learned: Applying the Metaphor to Real Estate Investing

The unfortunate Titan submersible incident offers crucial insights that extend well beyond the realm of deep-sea exploration. As we’ve discussed, parallels can be drawn between this event and the field of real estate investing.

Both pursuits are marked by elements of exploration, risk management, high-stakes decision-making, and the potential for significant, life-changing rewards.

Real estate investors, much like deep-sea explorers, must be prepared to venture into the unknown, manage risks effectively, and make decisions that can have far-reaching implications.

Based on these lessons, real estate investors would do well to approach their ventures with a spirit of exploration, recognizing that risk and uncertainty are inherent parts of the process.

Effective risk management, including thorough research and due diligence, should be a key component of their strategy.

When faced with high-stakes decisions, investors should weigh the potential consequences carefully, always aware that their choices could have significant impacts.

Lastly, investors should keep in mind the potential rewards that can come from successful investing, not just in terms of financial gains, but also the thrill of discovery.

These insights, taken from the deep-sea exploration world, can serve as valuable guides for those navigating the sometimes unforeseen depths of real estate investing.

Conclusive Expedition

As we reach the end of our kindred exploration, it becomes clear that the Titan submersible incident, as tragic as it was, serves as a profound metaphor for real estate investing.

The world beneath the sea and the world of real estate may seem worlds apart, yet the principles guiding successful navigation in both domains share striking similarities.

The courage to explore, the necessity of risk management, the weight of decision-making, and the potential for discovery and reward – these elements are universally applicable.

For real estate investors, these lessons gleaned from the depths of the ocean can illuminate the path ahead. Just as deep-sea explorers venture into the unknown armed with knowledge, courage, and unwavering respect for the power of nature, so too should investors approach their journey.

Throughout your real estate journey, embrace the spirit of exploration, manage risks meticulously, make informed decisions, and always keep the potential rewards in sight.

The depths of the ocean and the world of real estate investing are both fraught with challenges and deserve respect, but with the right mindset and strategies, they can also be realms of immense opportunity and massive discovery.