Answer:

To increase your property’s value and your NOI (net operating income), yes real estate investors should consider using property submeters.

Let’s get into the details of why.

Should Real Estate Investors Install Property Submeters?: The Utility Cost Of It All

After an initial capital investment, identifying the costs and returns would help ensure property owners weigh all possible options before arriving at conclusions, one of which is if they should install submeters.

Various systems across the world are developed to account for the electricity and water load in a building. Some say that submetering has been recognized as a powerful solution in improving the management and control of utilities if real estate investors and multifamily property owners understand how utility submetering works.

What are submeters?

Submeters are devices installed between a master utility meter and individual units within a facility. They usually measure different sections of a supply and allow monitoring of the usage on a portion of a building distribution network past the main meter.

Why should landlords invest in submeters?

Transparency and Accountability

Investing in a reliable sub-metering system allows landlords to manage utility expenses better.

Sending invoices out and non-payment of monthly utility bills on time gives real estate owners or landlords a severe headache.

But submetering creates transparency and accountability for the tenants and landlords.

When submetering systems are in place, tenants take control of their usage and spending, which lessens the risk of delayed payments, contrary to splitting the bill across different users who most likely end up in disagreements or contesting charges.

It makes a big difference when landlords charge residents for their consumption. Moreover, it creates a harmonious relationship between tenants in the same building.

Leakages and Malfunctions

As an added benefit, submeters provide data that can also serve as an evaluation of whether the device is functioning properly. Sometimes, it can also inform the user if the device is malfunctioning, which may need repair or replacement. Furthermore, they can detect water leaks in areas where it is challenging to spot, resulting in preventable expenses.

Water meters measure the water use or volume of water used by building units. Leak detection saves a lot of time, money, and stress in the long run as it becomes much easier to report leakages for prompt repairs, inform staff or the water company about possible dangers or mounting harm, and avoid such serious situations.

Many Water utilities struggle to provide safe and readily available water supplies because they are essential for public health and other sanitary purposes.

How do you find the right property for submeters?

In the real estate industry, any property with multiple tenants can use submeters. It can range from residential buildings like townhouses and condominiums and commercially for business leases like shopping centers or office towers.

Submeters can also be found in institutions such as hospitals and schools. Although there might be some differences in technicalities and procedures, overall, the implementation has similar benefits.

How much does it cost to install a submeter?

For an average home, submeter installation costs approximately $300 to $600, while the equipment or hardware costs around $120 to $180. On the other hand, installing a new water line could be as much as $5,000.

The cost of submetering for those who own multi-family housing units may reach several thousand, which includes purchasing and installation depending on the project’s size, location, and complexity.

The best way to get an accurate estimate is by hiring qualified and reliable personnel or a service company. It has been one of the reasons why some investors hesitate since they are quite expensive.

However, most case studies and reports indicate significant savings in energy and maintenance costs in the long run.

How to install submeters?

Scoping

The first step involves assessing the property’s current infrastructure and analyzing the details owners wish to obtain with the installation. It also includes the selection of appropriate submeters to use depending on the measured utility.

RELATED CONTENT

Also during the scoping process, items under consideration should be the building’s layout, the complexity of retrofit on older building designs for incoming new construction, and the amount of disruption when installing.

Scoping ensures that the metering system to be used observes the standards and follows the corresponding regulations and state law. Not all states operate by the same standards, so it is necessary to abide by local statutes to avoid legal issues.

Installation

After obtaining the analysis combined with the project’s intended objectives, a solid design is created to install the submeters. It includes details such as the level of submetering, the data collection type, and the software platform to use.

For new construction, the submeter system design comes after architecture and construction plans are finalized. The design is influenced by the unique layout and utility requirements which are then implemented afterward.

While retrofitting considers that the rental property is occupied, it requires a level of security, cleanliness, and decorum to perform its work. Therefore, replacing existing lines or applying plans for new structures takes place after choosing the utility system and devices.

Software and Reporting System

The reporting system is also vital in practicing submetering. Real-time relevant reports can be accessible to required users and stakeholders following standards and protocols.

Data must be traceable to the meter or device used and can bill residents for consumption accurately. In addition, individual tenants are no longer in doubt of being overcharged for their overall monthly utility bill.

American Utility Management (AUM) is a provider of resource conservation, utility management, and cost recovery solutions to residential, commercial, and institutional properties.

According to Dan Witte, executive vice president of sales at AUM, the creation of the latest submetering technologies system was in response to the market’s desire for real-time reporting.

Since AUM’s clients wanted more functionality over the Internet, they can now give them that access. Monitoring utility use can significantly impact tenant behavior to develop best practices for conservation.

Maintenance

The process does not stop after installation since the maintenance of submetering equipment is critical. Regular maintenance avoids technical difficulties and discovers any signs of malfunction, damage, or any other problems that may arise. With thorough inspections, owners can identify anomalies and potential issues earlier.

There are different ways to implement utility maintenance on multifamily properties or commercial properties, whether reactive or preventive.

Reactive utility maintenance permits the equipment to continue functioning until it fails, whereas, preventive utility maintenance involves regular inspections and acts as a good protection measure.

It is best to check regularly to ensure that electric submeters, water submeters, and the like reflect the precise utility consumption on their electricity and water bills.

When spotted, report anomalies to the rightful authority such as the property manager, landlord, or the utility company itself.

Benefits Of Submetering

Energy Savings

As an investor, energy metering can serve several purposes, one of which is increasing the building’s energy efficiency. It saves energy by up to 10% to 25% by reduction of unit consumption.

Metering motivates tenants to reduce energy use. As a result, it lowers the cost of utilities and rates since energy charges are rated accordingly.

As occupants gain awareness, they conduct energy-saving actions and contribute towards the whole building’s savings. As residents keep track of their usage, they gain control over their future energy usage.

The same goes for water sub-meters as they reflect the tenant’s water consumption. Imagine how much water they can save by applying water conservation practices and promoting sustainability in apartment properties or multi-family properties.

Maximize Building Value

On the other hand, building owners, landlords, and property managers can show commitment to building sustainability which may attract a new tenant and command higher rental market prices, increasing the value of the property with lesser property expenses.

Return On Investment

As the building management becomes more efficient, the property performs better, increasing net cash flow. When tenants pay for their utility costs, Net Operating Income (NOI) increases accordingly.

Studies show that a typical Return on Investment (ROI) period for using a submetering system ranges from one to three years. ROI is an approximate measure of an investment’s profitability calculated by subtracting the initial cost of investment from its final value then dividing the answer by the cost of the investment and multiplying it by 100.

Drawbacks Of Submetering

The most common drawback of installing submetering in an existing building is the disruption of utility services, such as electrical shutdown, water stoppage, or air conditioning and heating cessation. It can cause trouble for large-scale commercial buildings since installation affects the entire building’s occupants.

Although it can inevitably affect those living inside, it is necessary and important to let them understand the situation, plan the schedule, and inform them before any disruption.

There might be objections to privacy due to data collection and analysis, on top of the unprecedented costs associated with maintenance.

However, some flexible suppliers give the ownership of the data to unit or apartment owners, provide the option of self-billing, or allow data collection with user consent.

Applications or servers using various technologies such as third-party cookies to collect and store information can be uncomfortable since cookies follow users around the web and track their behavior to serve more relevant ads.

But users can block the use of cookies in their browser, opt out of these cookies, or warn them when permission for installing cookies is requested.

Another common drawback is utility theft, but it can be solved with vacant cost recovery (VCR). Moving in of new tenants can be complex and changing names or switching over utilities can slip out of mind.

With VCR implementation, the property will not pay for an occupied unit’s utility costs, instead, false charges can be redeemed and what was mistakenly allocated toward the property’s bill can be recovered.

Submetering vs RUBS

What is a RUBS system?

A Ratio Utility Billing System (RUBS) is a system used by landlords or property management companies to allocate utility costs among tenants.

The allocation of utility costs is often based on factors such as the number of tenants in a unit, the size of the unit, or other relevant factors.

How does RUBS utility billing work?

Ratio Utility Billing System (RUBS) uses a formula based on factors such as the unit square footage of a unit, number of occupants, amenities, number of bedrooms, and number of bathrooms to allocate utility costs among residents in multifamily properties.

RUBS billing does not require the installation or purchase of any device. In other words, the RUBS program is a way of assigning energy costs without submetering tenant spaces. Rental properties can implement quickly and easily.

It is a fair solution to help residents understand the cost of service from utility providers in properties and to help landlords bill them for utility usage when submeters cannot be feasibly installed such as in older buildings.

Some older properties are too old that modern installation is not possible anymore. Usually, when apartment buildings use RUBS, utility providers place one large meter like water, gas, or electric meter at the point where the utility enters the community.

The RUBS system uses software to charge tenants using the formula for distributing energy and utility use among units or tenants. Apart from the factors mentioned, it also considers the number of plumbing fixtures, stoves, gas fireplaces, heating, air conditioning, or ventilation.

How to calculate using RUBS?

The basis of the RUBS ratio is the occupancy rate per unit. It is likely due to a logical assumption that an apartment with a single tenant uses less water than those with multiple ones. The same assumption is applied to sewer and garbage disposal since more tenants equate to more water usage and more garbage.

There are three options and these are the following steps:

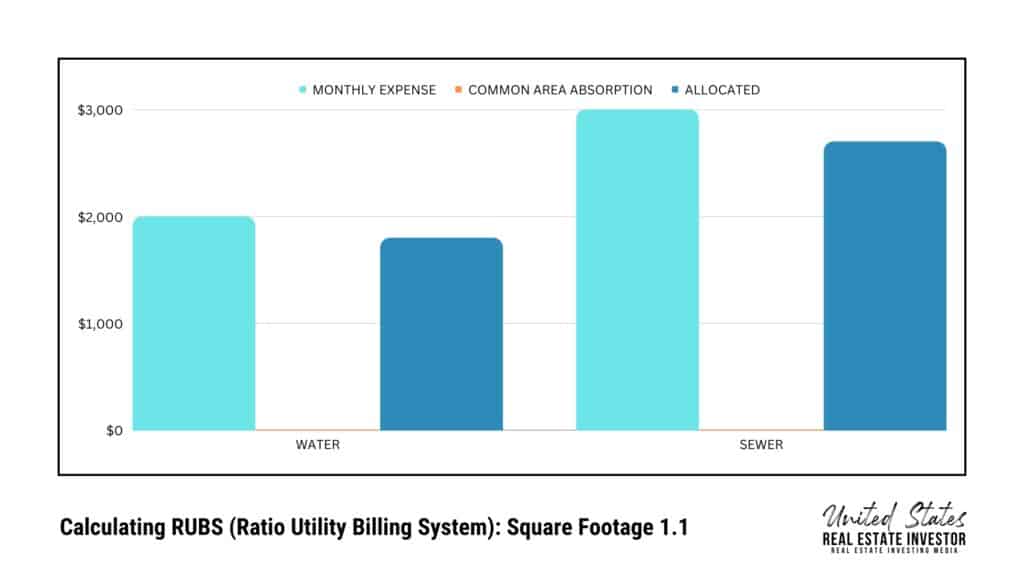

Option 1: Square Footage

Take the total occupied square footage of a unit, and divide it by the total occupied rentable square footage of the property. The Common Area Deduction (CAD), which is also called Common Area Maintenance Fee, is deducted from the total bill since this cost is absorbed by the property by some percentage before allocating to individual residents. This is an allocated portion of the property’s utility expense for common areas usage.

Additional Information:

Total Occupied Rentable:100,000 square feet

Unit A: 750 square feet

So, 750sq. ft. (of Unit A) divided by 100,000 sq. ft equals 0.0075, then apply the answer, which is the Utility Percentage, to the allocated expense for each utility.

As a result, the total utility bill of Unit A using the square footage option is $33.75.

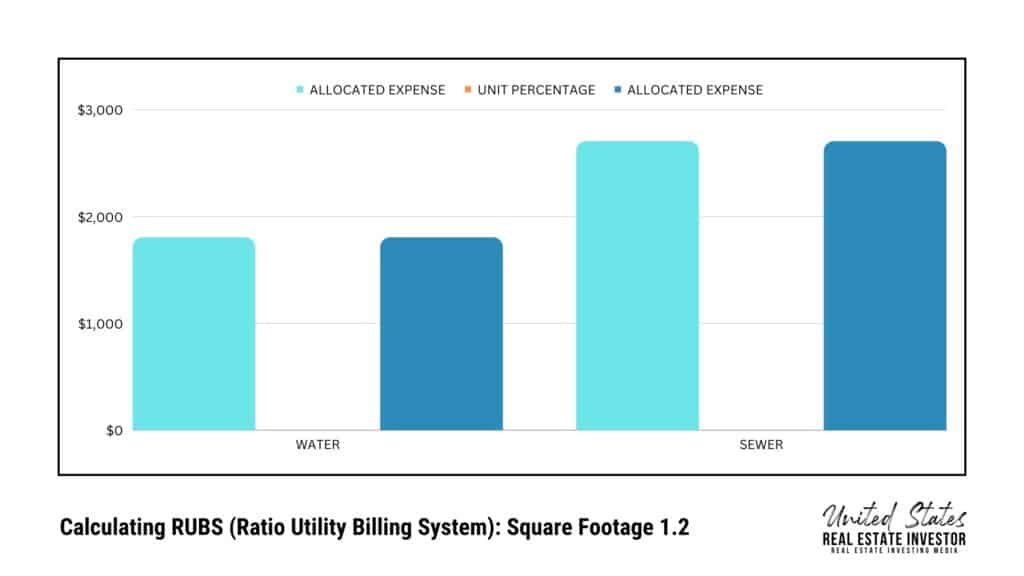

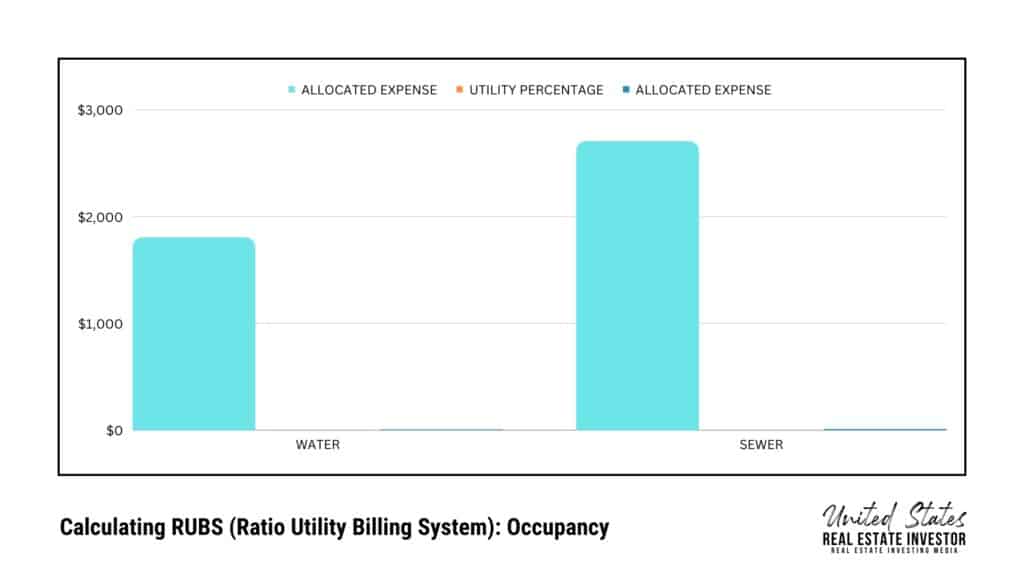

Option 2: Occupancy

Take the total occupancy of an individual unit and divide it by the total occupancy of the building or apartment units.

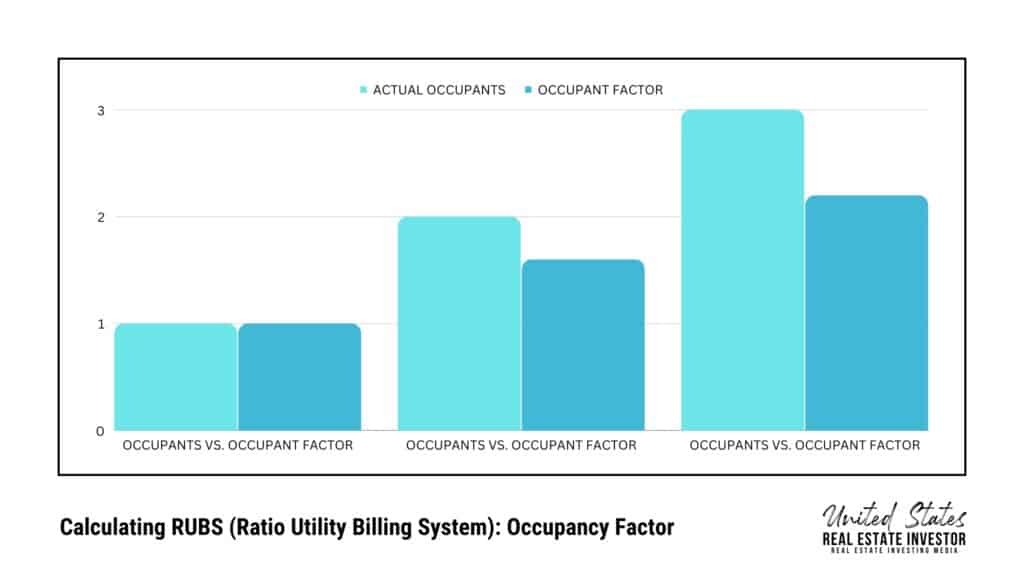

The Common Area Deduction is also deducted from the total bill to be allocated. Occupancy is the percentage based on the number of residents occupying the unit from the total occupants of the entire residential units, with less weight given to each occupant beyond the first.

And so on (per Occupancy Factor chart), with 0.04 for every additional occupant.

For presentation purposes, let’s use the same example above (Option 1). Unit A has 3 occupants so it has an occupant factor of 2.2. Let’s also assume that all other units add up to the 550 occupant factor. Therefore, 2.2 divided by 550 is 0.004.

As a result (per Occupancy chart), the total utility bill of Unit A using the Occupancy option is $18.

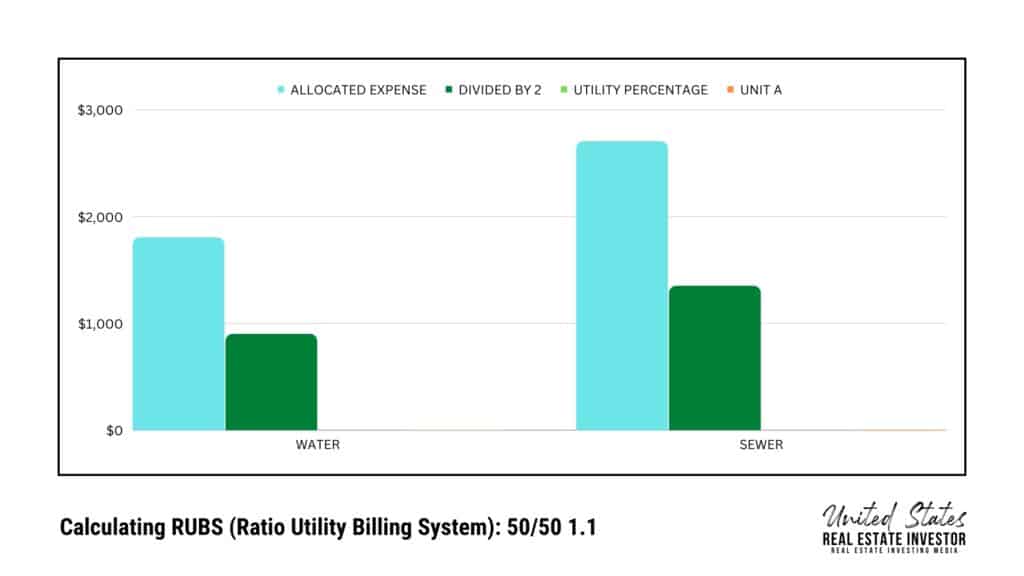

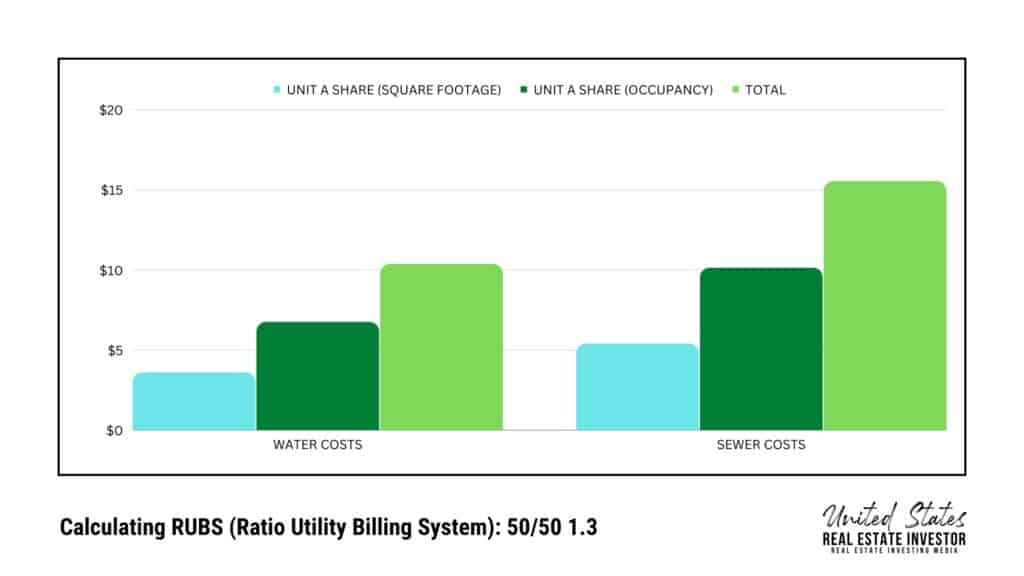

Option 3: 50/50

This option has a 50/50 split allocation; 50% of the utility bill based on occupancy, and 50% based on unit square footage.

Given the same example from Option 1 and Option 2, divide first by half the allocated expense which is after the deduction of Common Area Absorption. Then, divide the occupant factor for the unit which is 0.004 for unit A.

The same thing goes for the other half, which is the square footage. Divide the allocated expense by half then multiply by the Unit Percentage to get the Unit Calculated Share

Then, add them both together.

As a result, the total utility bill of Unit A is $25.88.

Conclusion

To avoid potential setbacks and employ the benefits, investors should look at the other competitors or projects that adopted the submetering system.

In that way, they can compare and establish their purpose and implement changes aligned with their objective. They must have thorough research about leading submetering and utility management companies such as National Exemption Service.

Switching systems requires patience, understanding, and a lot of work. Some landlords might offer lower rent to compensate for moving to utility submetering billing, which may take a while to adjust.

Overall, whether it is a multi-family property or commercial real estate, the submetering system is highly cost-effective and can be a financially viable component of energy cost management.

Submetering becomes a solution designed to generate data that guide management strategies, improve tenant interaction, as well as operational and investment decisions.

—

Please, leave a comment below to let me know what you thought of this article. Did it help you understand submeters better? Did it help inform your decisions?

I would love to know your thoughts.

No related posts.